SuMi TRUST is one of the largest asset managers in Japan, with AUM of USD 453 billion (as of 31st March 2015). Trust banks are major players in asset management industry in Japan, and SuMi TRUST is one of them. Total AUM of Sumitomo Mitsui Trust group including two dedicated asset management firms is USD 664 billion.

SuMi TRUST manages a broad spectrum of Japanese Equity products and is well known in Japan as a principal provider of Japanese equity products for corporate and governmental pension funds.

Japanese Equity is the central component of our business with AUM of USD 115 billion (as of 31st March 2015) representing a substantial revenue stream for the Group as a whole. Out of USD 115 billion mentioned above, USD 19 billion is for active management.

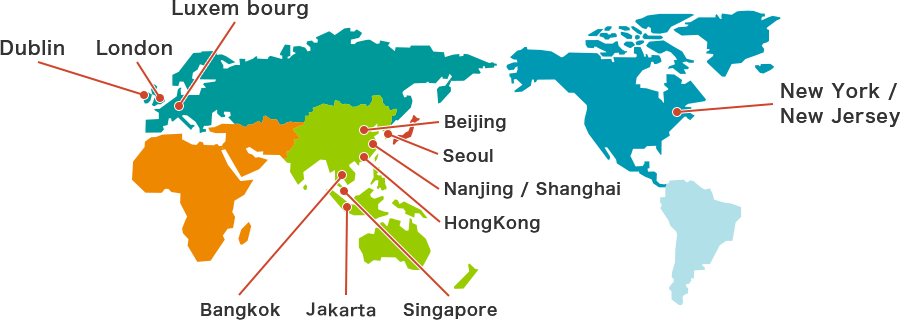

SuMi TRUST also provide products investing in Asian equities. The capability was developed through its experience in Japanese equity, although it maintains investment team in Hong Kong.

Facts and Figures

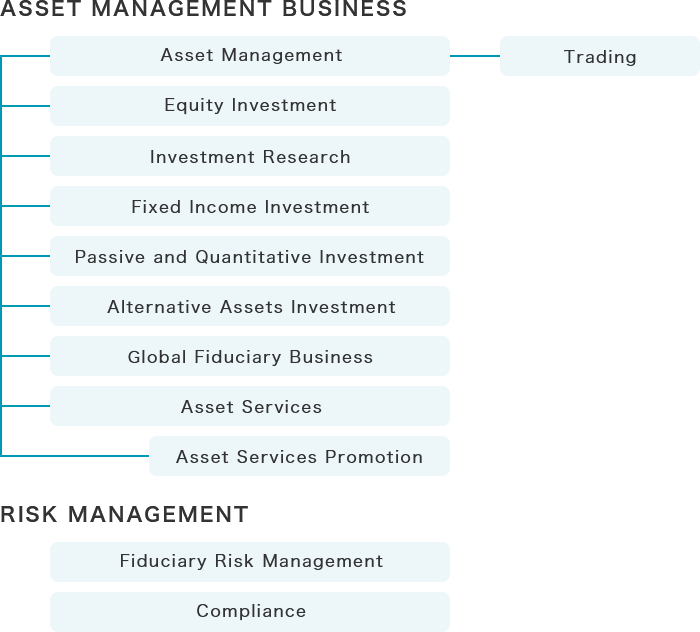

Organizational Chart

(As of April 1, 2015)

The structure of Japanese financial industry is unique. Trust banks practice investment management business and it is one of their major lines of business. In some of the major countries, banks are recognized as a different industry from investment management, but this concept does not apply to Japan. Historically, the only financial institutions authorized to manage corporate pension before 1997 were trust banks and life insurance companies. Trust banks’ consistent dedication to professional skills as well as relationship with investors has kept them as major players in asset management business in Japan.

Sumitomo Mitsui Trust Bank and other affiliated companies form Sumitomo Mitsui Trust Group. Other member firms engaged in investment business in the Group include the following.

Sumitomo Mitsui Trust International Limited

A wholly owned subsidiary of SuMi TRUST located in London. It provides investment products to overseas investors and securities lending service mainly for Japanese and European equities.

Sumitomo Mitsui Trust (Hong Kong) Limited

A wholly owned subsidiary of SuMi TRUST located in Hong Kong. It conducts securities investment and investment advisory business such as advisory for private equity fund investments.

Sumitomo Mitsui Trust Asset Management

A wholly owned subsidiary of SuMi TRUST located in Tokyo. It provides investment products to Japanese retail investors mainly through commercial banks and brokers.

(As of March 31, 2013)

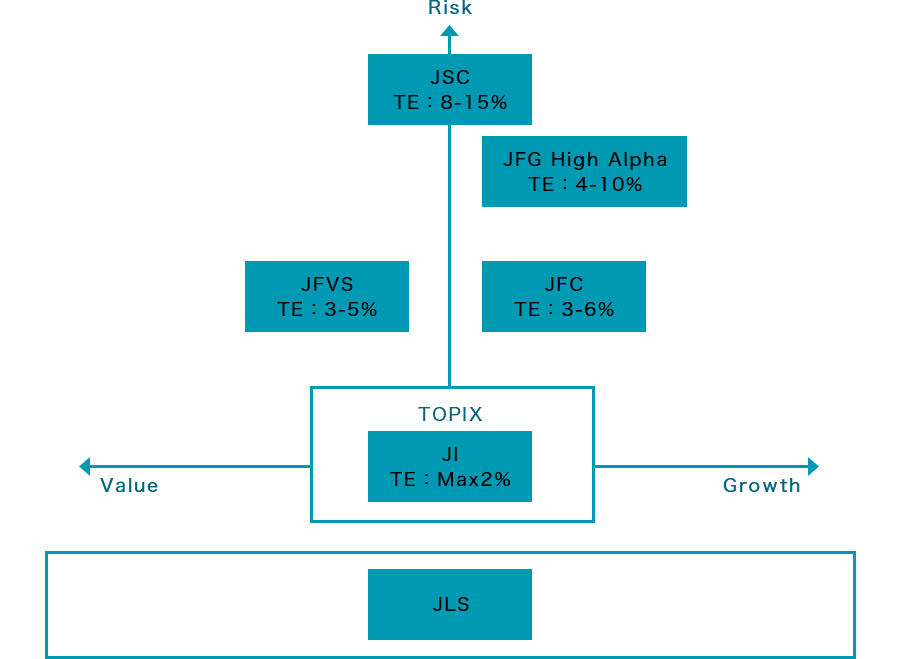

SuMi TRUST offers a comprehensive Japanese as well as Asian product suite to clients.

Japanese equity products include value, growth, as well as market neutral strategy. All the important investment decisions for Japanese equity products are made in Japan, based on the research and analysis conducted locally in Japan. Market neutral strategy of Japanese equity employs widely used Cayman fund structure and is managed through our Hong Kong subsidiary.

We also provide products investing in Asian equities. The capability was developed through the experience in Japanese equity. Our Hong Kong subsidiary has an investment team dedicated to Asian equity investment.

Note: The diagram shows relative risk return relation among each product. The diagram does not guarantee the future return of the products. Please refer to detailed information of each product when making investment decision.

The strategy is based on our belief that the Small Cap Sector of the Japanese stock market can provide excellent opportunity for consistent uncorrelated high returns. Managers seek to identify stocks with true upside potential that are overlooked or undervalued by the market.

*The strategy is also available in UCITS.

A strategy distilling the best of our non-consensus high conviction ideas. The strategy taps into a concentrated high conviction stock selection process based upon our significant research group located in Japan. The portfolio is constructed typically with 30-50 stocks.

A bottom-up fundamental research intensive strategy providing a high-conviction portfolio of mid to large-cap growth stocks. Managers and analysts seek undiscounted growth and invest to take best advantage. The domestic version of the strategy is a fund widely bought and held by Japanese pension funds. The portfolio is constructed typically with 60-90 stocks.

A value strategy focusing on the Free Cash Flow valuation and the consensus gap detected by our detailed research. The team invests in undervalued stocks which have high probability of earnings surprise potential.

*The strategy is also available in UCITS.

Replicates index subject to any additional investor criteria (such as high credit risk screening).

A strategy generating consistent alpha by forecasting earnings surprise on a market neutral basis. The strategy takes positions in 50-70 pairs of stocks, one short, one long where a consistent spread is generally anticipated by the market. This is a research driven strategy which additionally requires a deep understanding of the characteristics of the market. This can be used in conjunction with portable alpha strategies or passive exposure.

Investment products for non-Japanese investors provided through our London subsidiary, Sumitomo Mitsui Trust International.

Sumitomo Mitsui Trust Bank, Limited (“SuMi TRUST,” “we,” “us,” or “our”), as a “responsible institutional investor,” considers our exercise of voting rights in connection with entrusted assets (the term “exercise of voting rights” is used in the same sense below) to be one of the most important elements of our stewardship activities, and we will strive to ensure that our exercise of voting rights enhances the corporate value and encourages sustainable growth of investee companies, in order to maximize medium to long-term investment returns for our clients (beneficiaries).

Based on the revised Japan’s Stewardship Code (hereunder, the Code) which was published in March 2020, Sumitomo Mitsui Trust Bank, Ltd. (hereunder, the Bank) revised our “Guidelines on Stewardship Responsibilities” and “Guidelines on the Principles of Japan’s Stewardship Code”. As one of Japan’s premier institutional investors, we will fulfill our stewardship responsibilities.

Sumitomo Mitsui Trust Group, Inc., the parent company of the Bank, has established the ‘Policies regarding the Fiduciary Duties of the Sumitomo Mitsui Trust Group’ as its policies for “client-oriented” initiatives. The parent company has committed to enhance the corporate governance structure as it shifted to a company that includes a nominating committee, and to effectively fulfill our stewardship responsibility.

We will fulfill our stewardship responsibilities under the “Guidelines on Stewardship Responsibilities.

As part of our stewardship responsibility, we will appropriately manage conflicts of interest under our “Conflict of Interest Management Guidelines” and “The Enhancement of the Conflict of Interest Management Structure relating to the Asset Management Operation”.Also, we will require our external asset managers to have clear policy on how they manage conflicts of interest in fulfilling their stewardship responsibilities and publicly disclose it

In order to fulfill our stewardship responsibility by ensuring sustainable growth of the investee company, we will require our external managers to monitor and grasp the status of the investee company.

We will require our external managers to share and recognize common views with investee companies and resolve issues through constructive engagement.

As an institutional investor whose goal is the sustainable growth of the investee company, we will require our external managers to exercise our voting rights through “Sumitomo Mitsui Trust Bank’s Basic Policy on the Exercise of Voting Rights”, and publicly disclose the results of all voting records for all investee companies and how we voted on each issue for each company every quarter

In order to fulfill our stewardship responsibilities, we will periodically report to our clients.

To make dialogue with investee companies constructive and beneficial, and to contribute to the sustainable growth of the companies, we will develop skills and resources needed to appropriately engage with investee companies and to make proper judgments based on in-depth knowledge of the companies and their business environment and consideration for sustainability on their business

If we provide financial service such as proxy advice to institutional investors, we will support clients to fulfill their stewardship responsibilities and endeavor to play a key role in the investment community.

As a responsible institutional investor, we shall conduct stewardship activities, including engagement and proxy voting, with a view to enhance mid to long term corporate value. Through our stewardship activities, we will enhance the medium to long-term investment returns for clients and beneficiaries. Moreover we shall conduct our activities with strong consideration for environmental, social, and governance (ESG) matters which are referred in international initiatives such as Principles for Responsible Investment (PRI) and the United Nations Global Compact to which we are a signatory.

In accordance with Principles 3 and 4 of the Code, we will comply with the guidelines below and engage with companies as part of our stewardship activities. The revision or abolition of this guideline will be implemented after a final decision made by the Officer in charge of Fiduciary Services Business.