In March of 2019, as a pioneering initiative, Sumitomo Mitsui Trust Bank began offering Positive Impact Finance (PIF) loan agreement, as a loan for business companies with no restrictions on the use of funds, based on the Principles for Positive Impact Finance advocated by the United Nations Environment Programme Finance Initiative (UNEP FI).

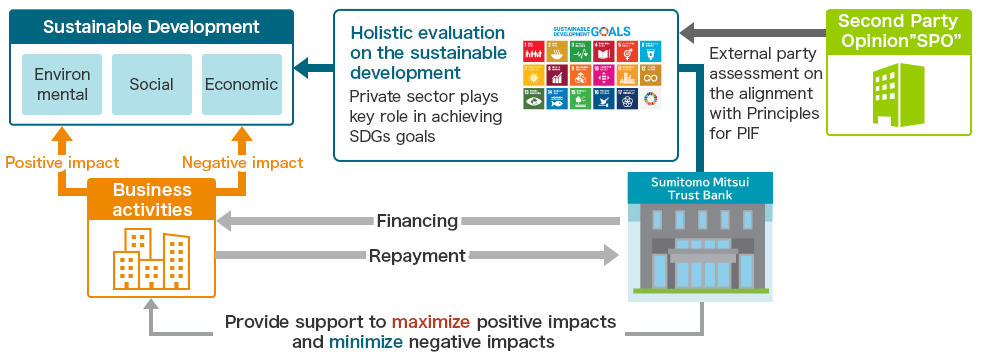

PIF is a finance initiative which comprehensively analyzes and evaluates the impacts (both positive and negative) which a company’s activities have on the economy, society, and the environment. In PIF, targets are set in regard to alleviating negative impacts while maximizing positive ones and focus is placed upon continuous engagement in order to ensure the realization of these targets. The product concept and other features of PIF have been highly evaluated, and in February of 2020, Sumitomo Mitsui Trust Bank’s PIF received the Gold Prize in the Finance Category of the Minister of the Environment’s first annual ESG Finance Awards Japan.

Since the Sumitomo Mitsui Trust Bank's first PIF loan agreement in March 2019, Sumitomo Mitsui Trust Bank has engaged in a total of 60 PIF loan agreements as of March 31,2024.

In addition, Sumitomo Mitsui Trust Bank has introduced a "Positive Impact Evaluation Framework" which enables companies subject to evaluation can refer to, when they receive financing also from other financial institutions using this framework, and was selected as a "Green Finance Model Case" by the Ministry of the Environment in FY2022.

UNEP FI is a partnership between the United Nations Environment Program (UNEP) and the global financial sector to mobilize private sector finance for sustainable development. UNEP FI works with more than 350 members – banks, insurers, and investors – and over 100 supporting institutions – to help create a financial sector that serves people and planet while delivering positive impacts. We aim to inspire, inform and enable financial institutions to improve people's quality of life without compromising that of future generations. By leveraging the UN's role, UNEP FI accelerates sustainable finance.

The Positive Impact Finance Principles consist of the following four principles, and one objective of the Principles is to promote positive impact finance for efforts to achieve the SDGs.

Positive Impact Finance is that which serves to finance Positive Impact Business. It is that which serves to deliver a positive contribution to one or more of the three pillars of sustainable development (economic, environmental and social), once any potential negative impacts to any of the pillars have been duly identified and mitigated. By virtue of this holistic appraisal of sustainability issues, Positive Impact Finance constitutes a direct response to the challenge of financing the Sustainable Development Goals (SDGs).

To promote the delivery of Positive Impact Finance, entities (financial or non financial) need adequate processes, methodologies, and tools, to identify and monitor the positive impact of the activities, projects, programmes, and/or entities to be financed or invested in.

Entities (financial or non financial) providing Positive Impact Finance should provide transparency and disclosure on:

The assessment of Positive Impact Finance delivered by entities (financial or non financial), should be based on the actual impacts achieved.

We are pleased to announce that we have become an inaugural signatory to PRB, which was proposed by UNEP FI and came into effect on September 22, 2019. By signing on to the Principles, we have committed to strategically conduct our business in a manner consistent with the Sustainable Development Goals (SDGs) and the Paris Agreement on climate change. By signing on to these principles, we are committing to be transparent about both the positive and negative impacts that our banks have on people and the planet, focusing on areas of high impact in our core business, setting targets for specific initiatives, and putting them into action to achieve our global and local SDGs.

In the Group's sustainability operations, we have set out issues to be addressed, including five major themes, and each of our businesses is working to realize the SDGs related to each of them. One of the five major themes is "climate change," and we will promote initiatives in line with the TCFD (Task Force on Climate-related Financial Disclosure), based on the objectives of the Paris Agreement. In addition, in our total solution services for corporate businesses, we will support our clients' transition to a sustainable direction that is consistent with the realization of the SDGs through our positive impact finance, ESG and integrated reporting consulting, and governance support programs.

The Principles for Responsible Banking is a commitment by signatories to align their business strategies and practices with the Sustainable Development Goals (SDGs) and the goals of the Paris Agreement. Since its launch, the number of signatories has grown from 130 to 200, representing about 40% of the world's banking assets (equivalent to more than 1.6 billion customer accounts), and is growing steadily. To commemorate the first anniversary of the launch, 10 digital contents of the signatories' specific initiatives in the form of interviews have been released by UNEP FI.

SuMi TRUST Bank defines impact as the short-, medium-, and long-term effects of a company's products, services, or activities on society, the environment, and the economy. Impact is characterized by direction (positive or negative) and magnitude (amount of change).

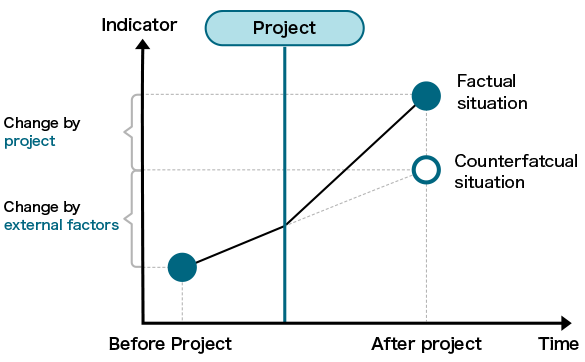

Impact measurement is the process of quantitatively and qualitatively grasping the "social and environmental changes, both short and long term," resulting from the activities, products or services of a company or organization, and making value judgments about its business and activities. The basic idea of impact measurement is to compare the situation in which a project was implemented or a new product or service was provided to the market with the situation in which the project or product or service was not implemented or not provided, and the amount of change is the impact.

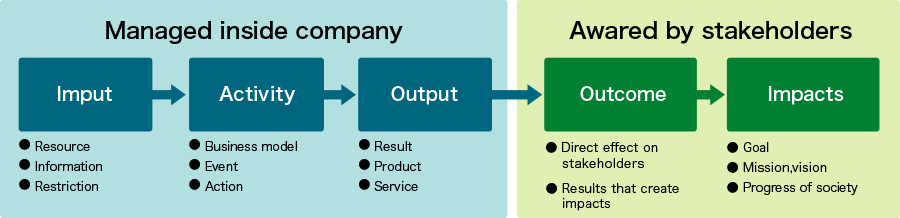

Impact Thinking is to think logically about the impact of one's actions or the activities of a company or organization and beyond, as shown in the figure below. Based on the following definition, SuMi TRUST Bank creates an impact pathway (logic model) by logically connecting multiple medium-term social and environmental changes (impact), outcomes for stakeholders (outcome), and outputs generated by corporate activities, and conduct impact measurement.

Definition of Output, Outcome and Impact

The results of a company's products, services, or activities.

The direct effect of a company's products, services, or activities on its stakeholders.

The effect of a company's products, services, or activities on society, the environment, and the economy in the short, medium, and long term. It has a direction (positive or negative) and a magnitude (amount of change).

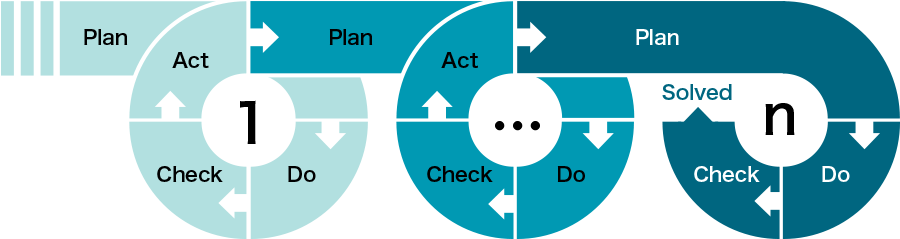

The purpose of impact measurement is not to evaluate impact. It is important for companies to use the results of impact evaluations to make decisions on how to "maximize change" from the current situation to increase positive impact or reduce negative impact. As a financial institution, SuMi TRUST Bank provides support for companies to use impact evaluation to improve their business and maximize their impact by correctly positioning it in the PDCA cycle.

SuMi TRUST Bank believes that when a company publicly discloses its impact-related action plans and results, it not only fulfills its accountability to its stakeholders, but also promotes the environmental and social value that the company generates, which in turn leads to increased corporate value. The Business Call to Action (BCtA), an initiative for inclusive development by the United Nations Development Programme (UNDP), and the Global Reporting Initiative (GRI), which issues guidelines for sustainability reporting, have collaborated to issue the report "Measuring Impact: How Business Accelerates the Sustainable Development Goals", which summarizes non-financial disclosure (sustainability reporting) and impact assessment as follows. In other words, UNDP and GRI argue that impact measurement is necessary if companies are to relate their activities, products and services to the SDGs.

To demonstrating and communicate progress toward social, economic, and environmental objectives.

To ensure transparency and accountability of business.

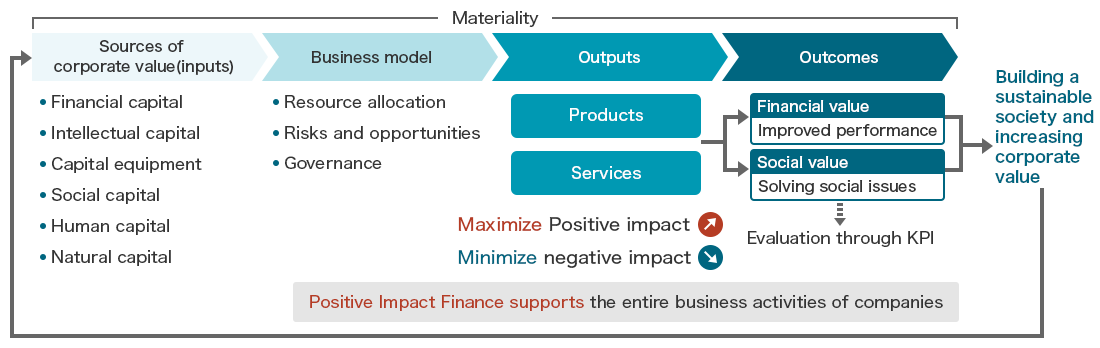

Positive Impact Finance is a financing scheme that comprehensively analyzes and evaluates the impact (positive and negative) of corporate activities on the environment, society and the economy, and aims to provide continuous support for such activities. The most distinctive feature of this type of financing is that it utilizes the degree of contribution to the achievement of the SDGs by a company's activities, products, and services as an evaluation index and monitors them based on disclosed information.

SuMi TRUST Bank supports the efficient and effective operation of the value creation process and the cyclical improvement of business activities and results by assessing the environmental, social, and economic impact of a company's overall commercialization activities through the Positive Impact Finance and monitoring KPIs.

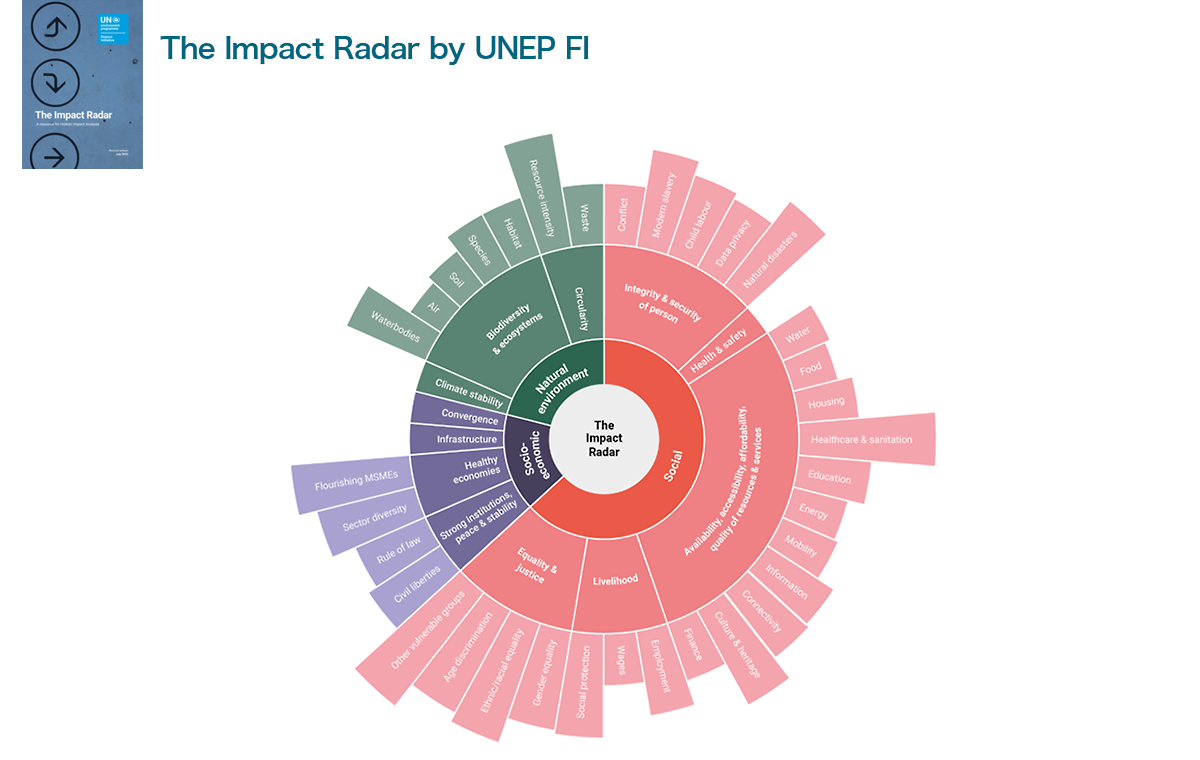

Based on the Impact Radar disclosed by UNEP FI, SuMi TRUST Bank identifies the items that will have an impact by industry and by individual company.

Source:BASED ON UNEP FI IMPACT RADER 2022 Impact Rader - United Nations Environment - Finance Initiative (unepfi.org)