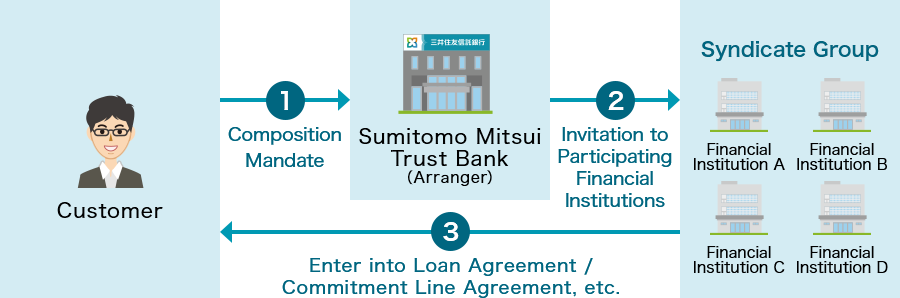

A syndicated loan is a fundraising scheme in which an “arranger” (a lead financial institution) forms a syndicate of lenders to provide loans on the same terms and conditions under a single contract to satisfy the funding needs of clients. The SuMi TRUST Group uses syndicated loans not only for conventional corporate loans but also for real estate finance, ship finance, buyout finance, and other structured finance transactions.

The arranger receives a mandate from the customer and composes a syndicate group.

*1The Arranger may also participate in the syndicate group.

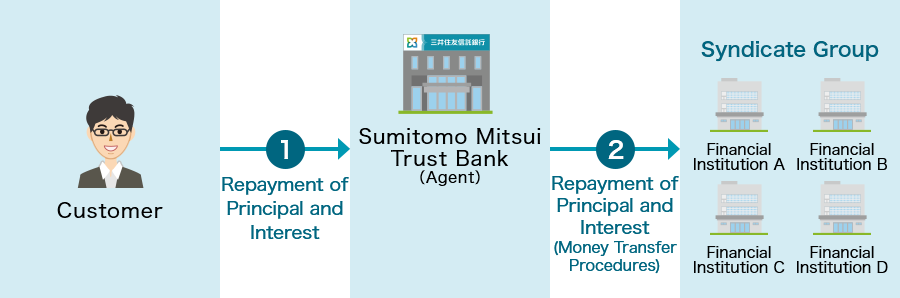

Unlike conventional financing, an agent representing each lender intermediates between the lender (participating financial institution) and the borrower (customer) and handles various procedures.

*2It is common for the financial institution that acted as the arranger to act as the agent.

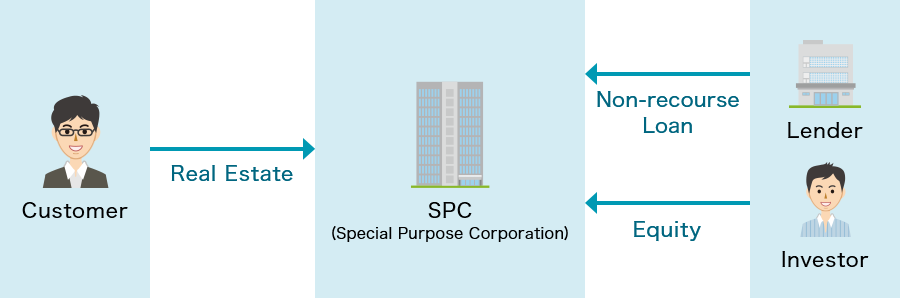

In real estate finance, we provide non-recourse loans to our clients based on either current and/or future cash flows of the collateral properties using our best knowledge and expertise earned through one of the longest history of this business in Japan.

We also serve our clients by providing equity money to support their investment and securitization business.

The real estate non-recourse loan is one of the means to facilitate financing for purchasing real estate in which real estate securitization*1 is carried out and the assets are transferred to an SPC*2. The loan itself is repaid exclusively from the cash flow originating from the real estate or the proceeds of its sale. The Wholesale Financial Services Business coordinates with the Real Estate Business and the overseas offices to actively capture good quality real estate finance projects both in Japan and overseas. As a result, the SuMi TRUST Group has currently secured a top class position in this field among Japanese financial institutions.

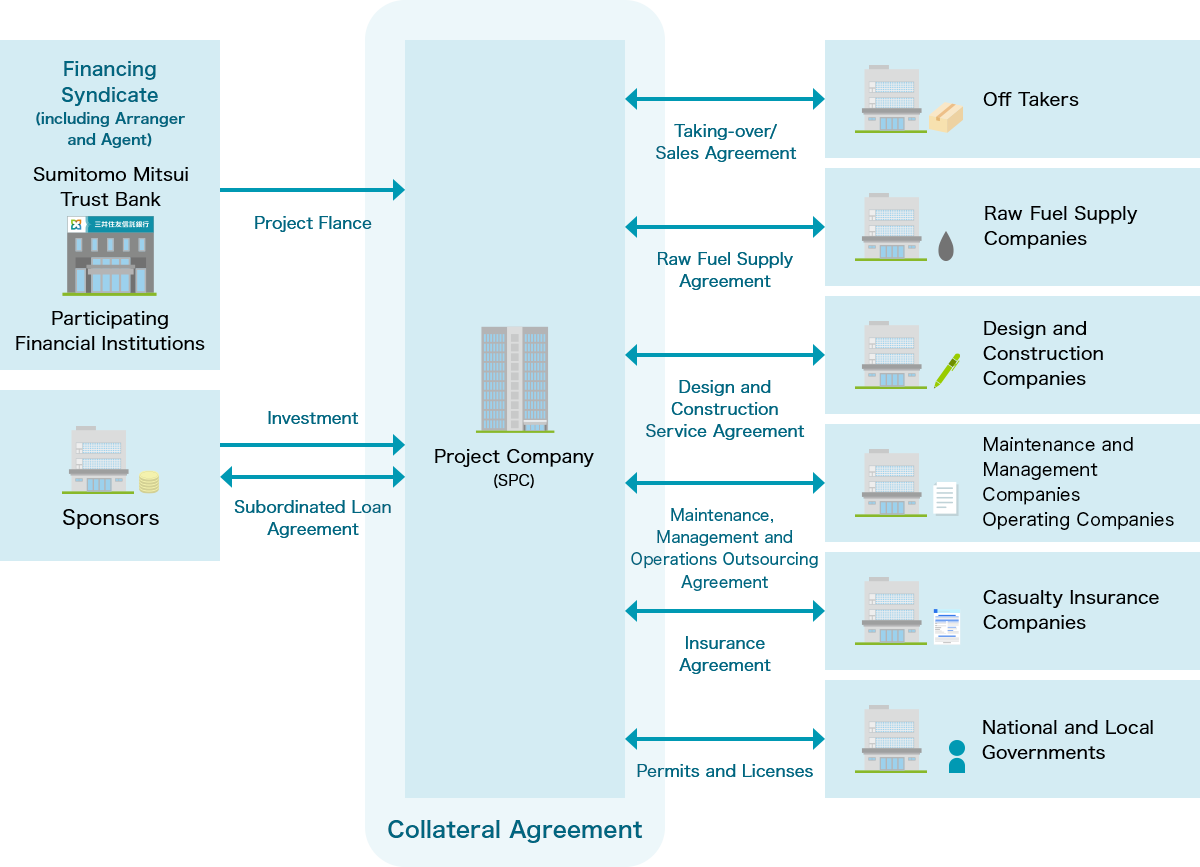

Project finance, which employs the cash flow generated from specific projects as the repayment source and limits its collateral to the relevant project's assets, is used to raise funds for infrastructure projects such as the building of power plants, railroads, roads, ports, etc., and oil refineries, petrochemical plants, and natural resource exploration. The SuMi TRUST Group responds to domestic and overseas capital needs in a wide range of areas, including wind power and other renewable energy projects, as well as PFI (Private Finance Initiative) and PPP (Public Private Partnership) projects.

Asset finance is a financing technique in which the cash flow generated by assets belonging to a corporation or other body is used to repay loans.

Ship finance is a global financing method for the building or purchase of ships, which is backed by various types of set collateral and the cash flow generated by the ships (mainly charter fees). The SuMi TRUST Group has built up expertise and a record of achievements in this area over many years.

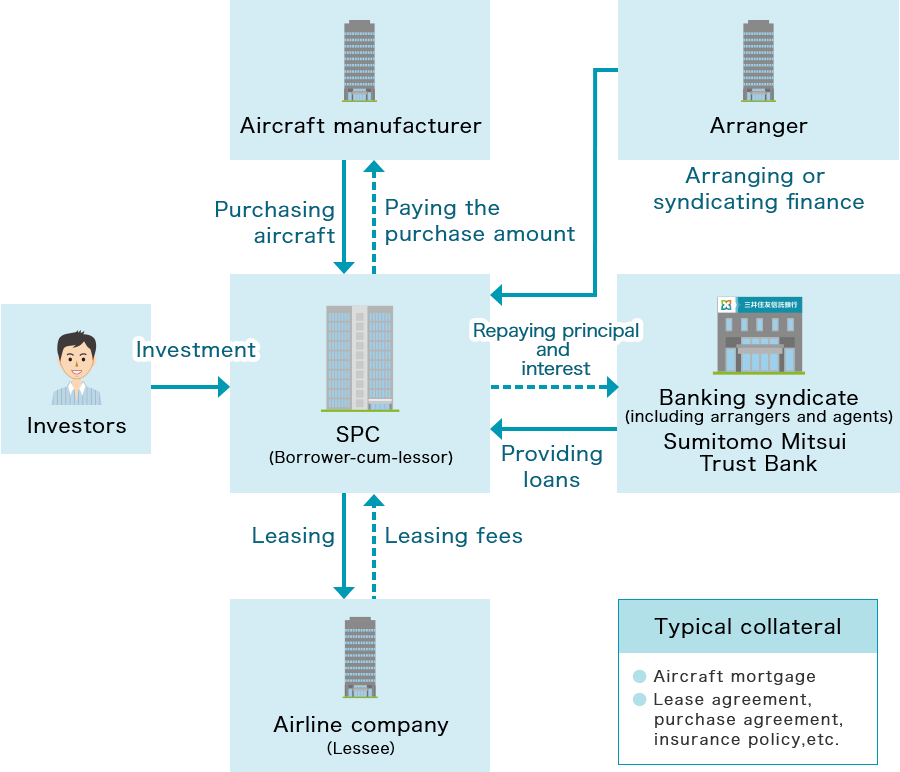

Aircraft finance is a financing method to provide funds for the acquisition of aircraft while appropriately managing the creditworthiness of the airline and the value (and structure) of the aircraft. A specialized team is now doing business with airlines and aircraft leasing companies worldwide.

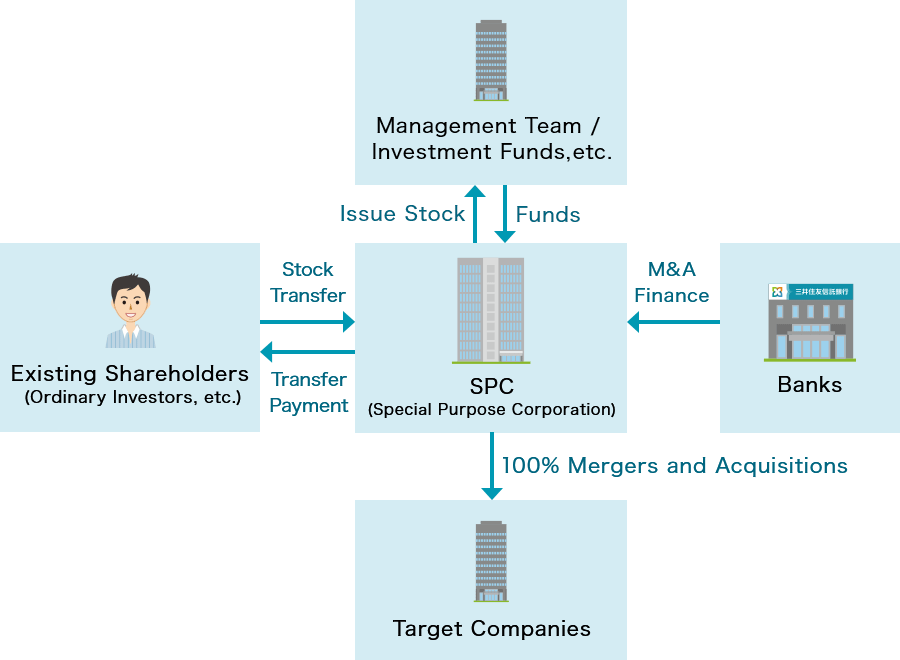

M&A finance consists of finance for the purpose of providing acquisition capital when private equity funds acquire a company, or when a company's management seeks to buy out its own company or a single business unit in the company. The SuMi TRUST Group provides solutions to various management issues, such as recapitalization and business succession for owner-managed listed companies, in addition to solutions to the increasing need for Japanese companies to acquire overseas companies and need of companies to sell their non-core businesses. The SuMi TRUST Group arranges a wide range of financings related to these acquisitions.

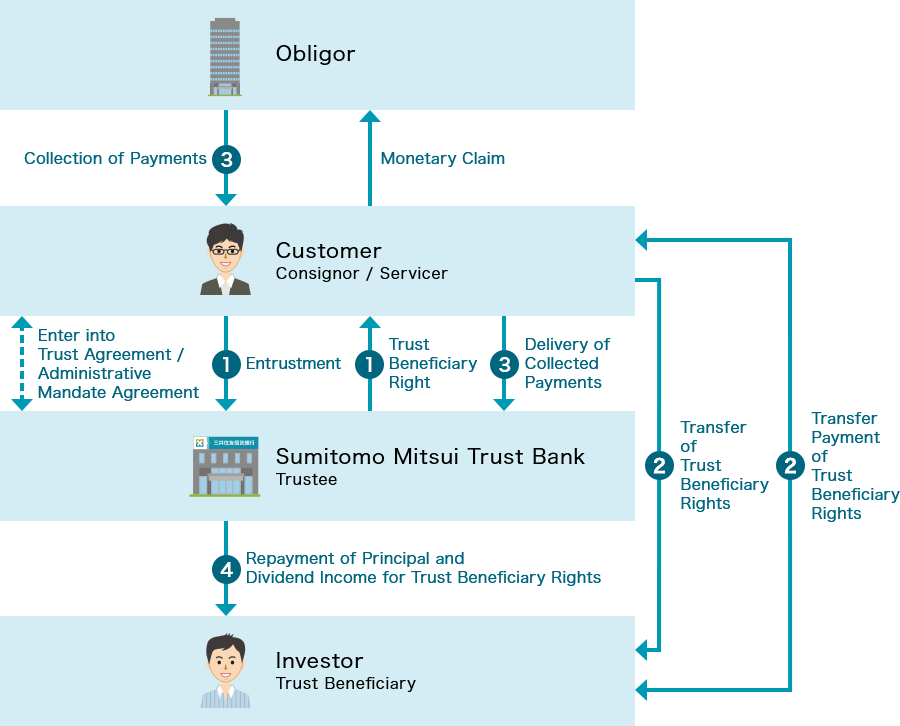

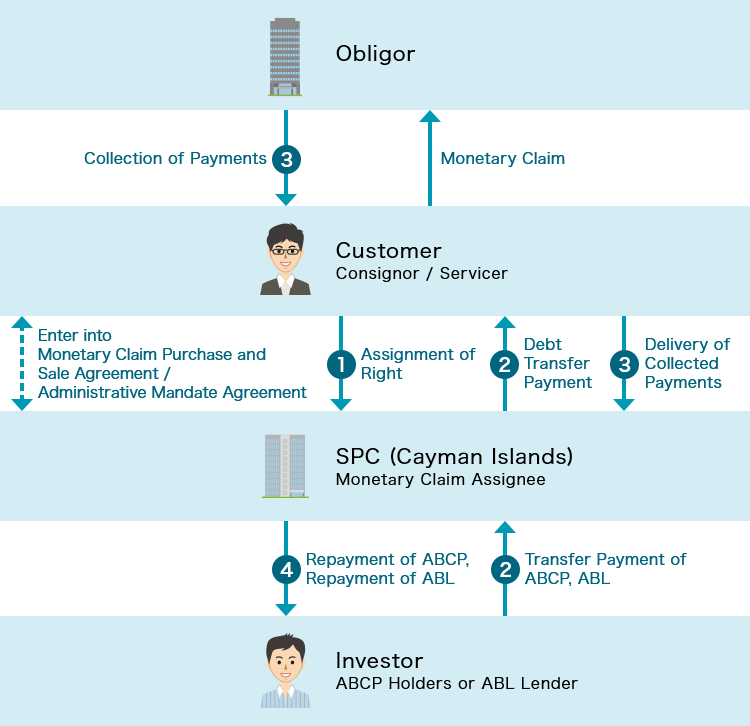

Asset securitization arrangements are operations that involve splitting off specific assets such as monetary claims (loans and bills discounted, accounts receivable, etc.) and real estate* from their owners and creating financial instruments based upon the revenue (cash flow) generated by these assets to raise funds.

Asset securitization methods include (1) the trust method (a method of entrusting assets and allowing investors to obtain beneficiary rights) and (2) the SPC method (a method by which assets are transferred to a corporation such as an SPC and securities are issued that treat these assets as collateral). The SuMi TRUST Group was an early pioneer of asset securitization arrangements. For example, we developed accounts receivable trusts in 1991 and we have been making active efforts to develop new products. As a result, the SuMi TRUST Group has currently secured a top class position in the asset securitization field among domestic financial institutions in terms of both quality and quantity. In addition to our asset securitization arrangements, we have also provided solutions to various management issues of our clients by making active use of our trust function.

*Real estate-related securitization is provided by the Real Estate Business.